tax management

Tax Management

Tipco Asphalt Group (the Group) strongly commits to good corporate governance principles and transparent business conduct while serving as a good corporate citizen in line with sustainable development philosophy across economic, social, and environmental aspects. In this regard, the Group establishes the following tax management guidelines to adhere to relevant rules and regulations, as well as the spirit and letter of the laws and regulations in the countries in which the Group operates.

Management approach

The Group has announced its Tax policy. All relevant details are explained through the online system. This policy covers the measurement and assessment of tax risks, tax filing in a timely manner, tax-related impacts associated with new investment projects. In addition, the Tax policy states that all related party transactions within the Group are conducted in accordance with in accordance with international tax principles and the arm’s length principle for transfer pricing.

The Group shall not conduct intentional tax evasion and refrains from utilizing tax structures without commercial substance, as well as refraining from transferring value created to low tax jurisdictions or investment in the so-called “tax havens”.

Stakeholders :

Investors, Regulators, Board of Directors, and Employees

Short-term goals :

- Digitalize tax operations processes

- Organize knowledge sharing session for employees on tax regulations

Long-term goal :

- Evaluate and review tax risks for transparency and compliance with regulations

- Continue to develop the potential and enhance tax knowledge among employees

Key Performances :

- Digitalized tax operations process to be digital, such as adding electronic withholding tax submission and filing taxes through an electronic system.

- Arrange external training courses for employees whose jobs relate to tax

Tax reporting

Implementing tax policies is the first step towards transparency and better governance. The list of countries of that the Group has operated in 2024, along with key activities, revenue, profit (loss) before income tax, income tax accrued, income tax paid, and number of employees, are as follows:

Country | Revenue | Profit (Loss) before tax | Income tax accrued (current year) | Income Tax expense | Income tax paid | Number of Employee (FTE) ¹/ |

|---|---|---|---|---|---|---|

Thailand

| 21,369,445

| 1,950,098

| 344,368 | 363,620 | 224,055 | 1,108 |

Other Countries

| 6,594,456

| (84,958) | 25,797 | 47,345

| 117,472

| 834 |

Total | 27,963,901

| 1,865,140 | 370,165 | 410,965 | 341,527

| 1,942 |

1/Information as per section 7.5 in E-report

Entities and Business Activities by Locations

Entity’s name | Main Business Activities | |

|---|---|---|

Thailand

| Tipco Asphalt Public Company Limited

| Manufacture and distribution of asphalt and petroleum products

|

Raycol Asphalt Co., Ltd.

| Manufacture and distribution of asphalt products

| |

Thai Bitumen Co., Ltd.

| Manufacture and distribution of asphalt products

| |

Ravana 1020 Co., Ltd.

| Distribution of machine, materials and tools relating to road construction

| |

Indrachit Holding Co., Ltd.

| Holding company

| |

Tipco Maritime Co., Ltd.

| Shipping management and agency

| |

Alpha Maritime Co., Ltd.

| Marine transportation

| |

Bitumen Marine Co., Ltd.

| Marine transportation

| |

Tasco Shipping Co., Ltd.

| Marine transportation

| |

Thai Slurry Seal Co., Ltd.

| Road rehabilitation services and sales of construction materials

| |

Thanomwongse Service Co., Ltd.

| Construction service and sales of construction materials

| |

Other Countries

| Kemaman Oil Corporation Sdn Bhd

| Holding company, manufacture, storer, tank rental and distribution of asphalt and petroleum products

|

Kemaman Bitumen Company Sdn Bhd

| Manufacture, refinery, storer and distribution of asphalt and petroleum products

| |

KBC Trading Sdn Bhd

| Distribution of asphalt products

| |

Highway Resources Pte. Ltd.

| Holding company

| |

Highway Resources Trading Pte. Ltd.

| Dormant

| |

AD Shipping Pte. Ltd.

| Marine transportation

| |

Reta Link Pte. Ltd.

| Dormant

| |

Pacific Bitumen Shipping Pte. Ltd.

| Marine transportation

| |

Asphalt Distribution Co., Ltd.

| Manufacture and distribution of asphalt products

| |

PT Asphalt Bangun Sarana

| Manufacture and distribution of asphalt products

| |

PT Saranaraya Reka Cipta

| Manufacture and distribution of asphalt products

| |

Tipco Asphalt (Cambodia) Co., Ltd.

| Manufacture and distribution of asphalt products

| |

Tipco Asphalt Lao Co., Ltd.

| Manufacture and distribution of asphalt products

| |

Tasco International (Hong Kong) Ltd.

| Holding company

| |

Langfang Tongtai Road Material Co., Ltd.

| Manufacture and distribution of asphalt products

| |

Tipco Asphalt (Xinhui) Co., Ltd.

| Manufacture and distribution of asphalt products

| |

Guangzhou Tipco Asphalt Trading Co., Ltd.

| Distribution of asphalt products

|

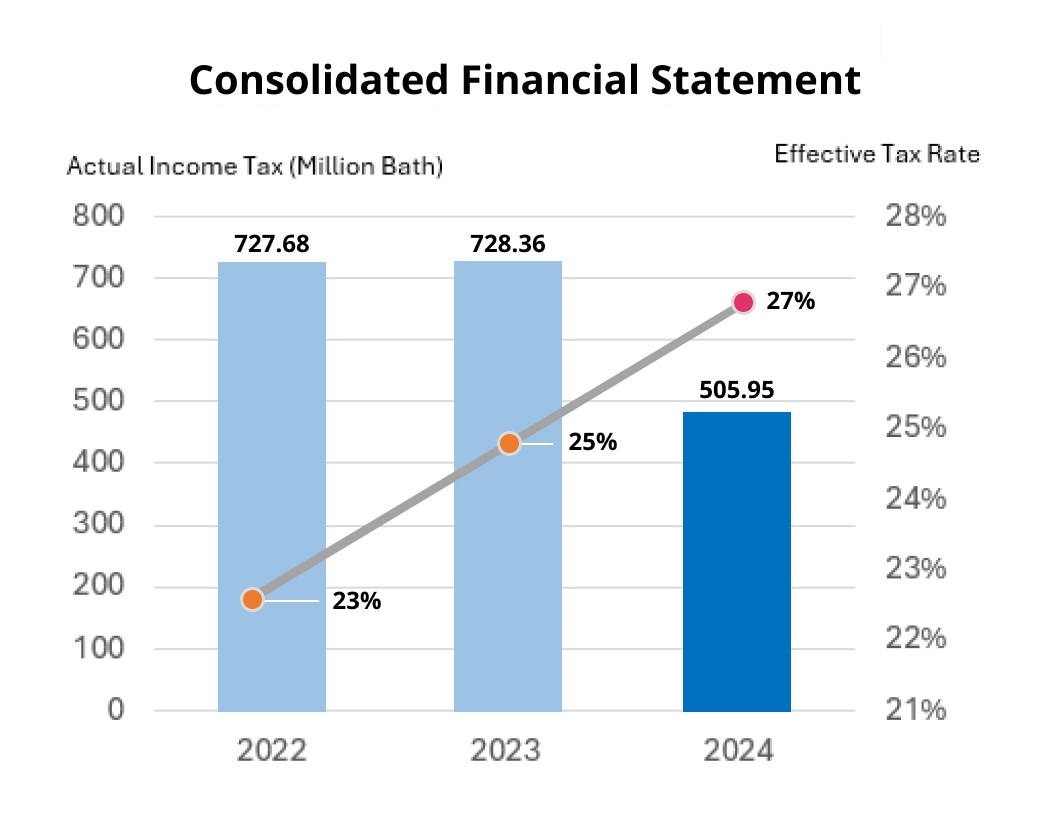

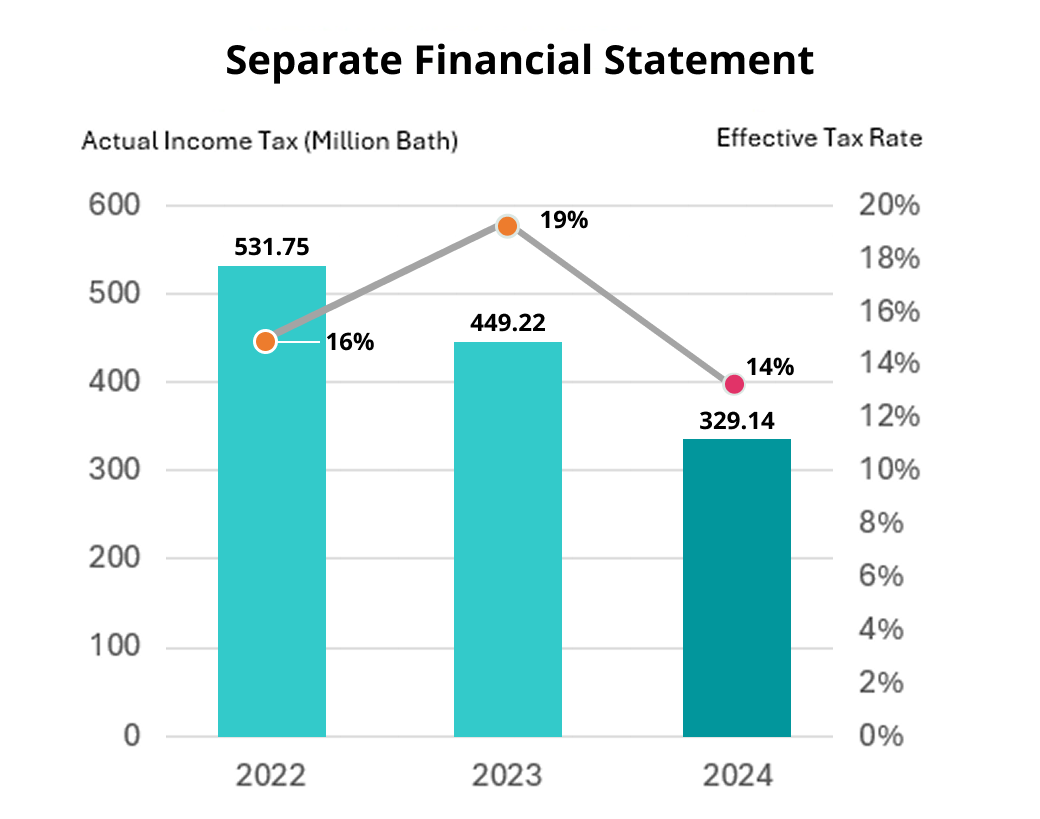

Effective Tax Rate

The corporate income tax rate for the Group, a group of companies, is in the range of 17% – 25%. The corporate income tax rate in Thailand is 20%. In the year 2024, the Group had a corporate income tax rate of 27% based on the consolidated financial statements and 14% based on the separate financial statements.

| ITEM | 2022 | 2023 | 2024 | |||

| Consolidated Financial Statement |

Separate Financial Statement |

Consolidated Financial Statement |

Separate Financial Statement |

Consolidated Financial Statement |

Separate Financial Statement |

|

| Sales & Service Income | 30,024.76 | 25,944.95 | 27,604.65 | 23,383.18 | 25,797.01 | 22,377.06 |

| Constuction Income Tax | 3,375.78 | - | 3,501.35 | - | 2,166.89 | - |

| Profit Before Income Tax | 3,120.26 | 3,306.55 | 2,908.67 | 2,312.25 | 1,895.14 | 2,284.42 |

| 20% Corporate income Tax rate (Thailand) | (624.05) | (661.31) | (581.73) | (462.45) | (373.03) | (456.88) |

| Corporate Income Tax | (727.68) | (531.75) | (728.36) | (449.22) | (505.95) | (329.14) |

| Corporate Income Tax Rate | 23% | 16% | 25% | 19% | 27% | 14% |

Consolidated Financial Statement

Separate Financial Statement

Explanation for Differences in Corporate Income Tax and Effective Tax Rates

The difference between the corporate income tax rate in Thailand (20%) and the effective tax rate is illustrated as follows:

Tax Benefits | Amount (Thousand Baht) |

|---|---|

Tax Benefits Tax privileges for ocean freight business ¹/ | 45,417 |

Investment Promotion Act International Business Center (IBC) ²/ | 629 |

Unused tax loss and unutilized investment tax allowances of current year | (94,783) |

Non-taxable income/expenses | Amount (Thousand Baht) |

|---|---|

Share of profit from investment in joint ventures and associates | 15,481 |

Expected Credit Loss | (52,825) |

Difference depreciation for tax purpose | (16,674) |

Fair value adjustment of asset from business combination | (22,886) |

Others | (7,284) |

Differences in Corporate Income Tax (20%) and Effective Tax Rates | (132,925) |

Note :

¹/ Subsidiaries in Thailand engaged in the shipping and handling of vessels enjoy exemption from corporate income tax on their income from international marine transportation as per Notification No. 72 issued by the Director-General of the Revenue Department.

²/ The company receives tax privileges for operating as an international business center, providing administrative, technical, and support services, and being classified as an international trading company. This privilege entails the reduction of the corporate income tax rate for international business center activities over 15 accounting periods, from 1 June 2019 to 31 December 2033.